Environmental Profit & Loss Accounting- in short EP&L, is a great method for measuring and quantifying the environmental impact of an organization’s activities.

Sports brand Puma was the first company to create and publish an EP&L report on its environmental footprint back in 2011. Since then, the recognition and need for environmental transparency and accountability have caused many large companies, such as Gucci and Phillips, to follow in their footsteps.

So, why’s an EP&L so useful? Which companies use it? How do they use it?

First- what’s an Environmental Profit & Loss (EP&L) account exactly?

A traditional Profit and Loss (P&L) account determines where an organization could be more cost-effective in its operations. This is the same for an Environmental Profit and Loss account, but with environmental factors.

The Environmental Profit & Loss account is a method for placing a monetary (relating to money) valuation on a company’s environmental impacts. Including the environmental and social impact derived from all its business operations and the entire supply chain. This scope on what parts of your business operations you want to measure is also called from ‘cradle-to-grave’*

*Cradle to grave is a scope within the method Life Cycle Assessment (LCA). It assesses the environmental impact associated with all a product’s life phases – from the raw material extraction phase until its waste disposal phase.

An EP&L account is calculated through a Life Cycle Assessment (LCA). In an EP&L, LCA Midpoint indicators (environmental impact categories from LCA’s) are calculated and subsequently monetized (€).

Why is an EP&L so useful?

An EP&L account is expressed in economical valuations (£, $ and €) instead of different environmental impact outcomes such as kg CO₂-eq or kg CFC-11-eq. This enables organizations to compare and consolidate different types of environmental impact (such as global warming potential, particulate matter or toxicities). Environmental impact can now be expressed in a single indicator.

EP&L expresses sustainability in terms that all businesses understand. It talks money.

This is why it’s an incredibly effective way for companies to take the proper sustainable decisions and implement a profitable sustainability policy. It’s no surprise that an EP&L increasingly becomes desired information on capital and environmental risks for investors.

So, which companies work with EP&L accounts? Most importantly- how do they use their results?

5 large companies who use EP&L accounts to report their environmental impact

1. Philips

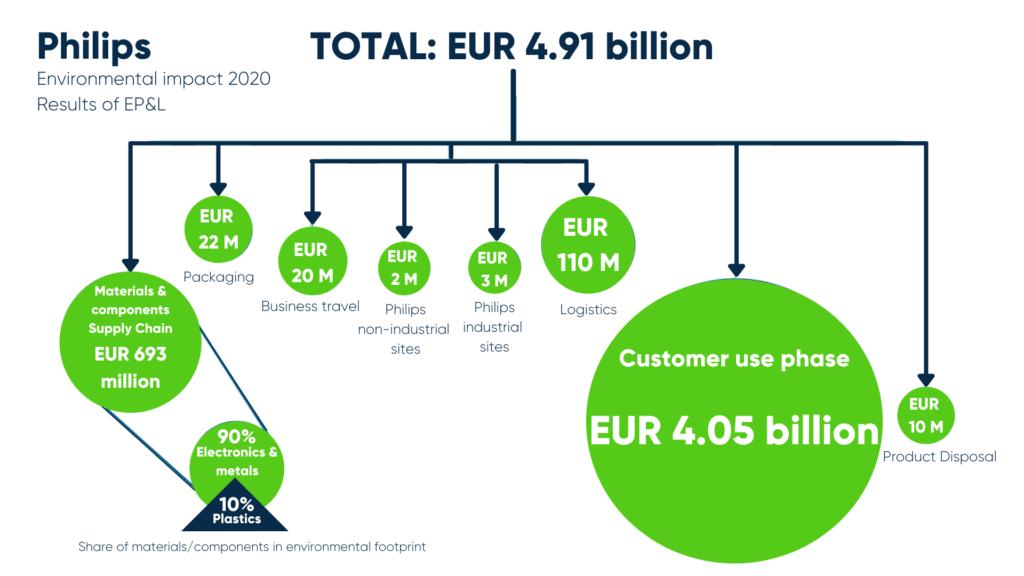

Since 2017, Philips annually uses Ecochain’s platform to report their environmental performance- with their latest EP&L account in their 2020 annual report (image 3). A great way for Philips to stay on track of their reduction efforts and further improve sustainability targets.

Philip’s 2020 EP&L account, interestingly, revealed that the largest environmental impact hotspot lies in the customer use phase of their products- with 83% of their total environmental footprint/EP&L (that’s €4.05 billion). This is because their consumer products often have large sales volumes and have long lifetimes through which they frequently require high energy consumption (e.g think of their hair care products). Their second largest hotspot is their supply chain– with 14%. Main contributors here are: the electronic components, cables, and steel used in our products.

This provides Philips with clear and strategic information. The key focus areas for Philips to make significant changes include: (1) reducing the energy consumption of products in their use phase (by implementing ecodesign). And (2) working with designers and suppliers to reduce the upstream manufacturing of components.

→ Read our full case study on Phillip’s EP&L account right here.

2. Kering Group (Gucci, Yves Saint Laurent, etc.)

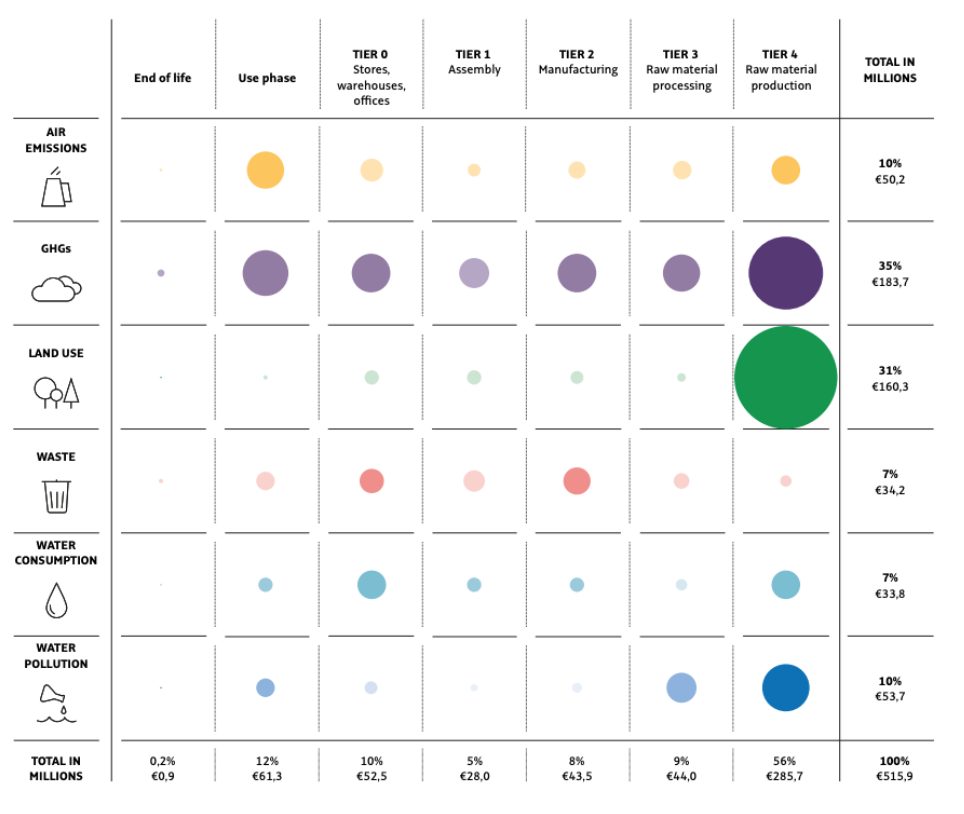

Kering is the French-based multinational corporation that owns the luxury brands Gucci, Yves Saint Laurent, Bottega Veneta- but also Puma. The group has been measuring its environmental footprint through an EP&L account since 2012.

Their 2020 EP&L account shows that most of their brands’ environmental impact comes from their supply chains- with 78% of the total EP&L (€401.2 million). Specifically the production and processing of raw materials stands out in terms of impact, with 65% of their total EP&L (€329.7 million). Interestingly, the consumer use phase and end-of-life phase (recycling/waste) represent a good 12% of their total footprint.

These results show exactly what impact ‘hotspots’ Kering Group should focus on to reduce their footprint the fastest. Kering’s 2025 Sustainability Strategy will focus on (1) reducing the footprint of the raw materials they use for their products. And (2) is working on possible interventions to reduce consumer’s use phase and end-of-life phase. (E.g. customer outreach programmes or product care labels to build consumers awareness.)

→ Read Kering’s full EP&L report right here.

3. Vodafone

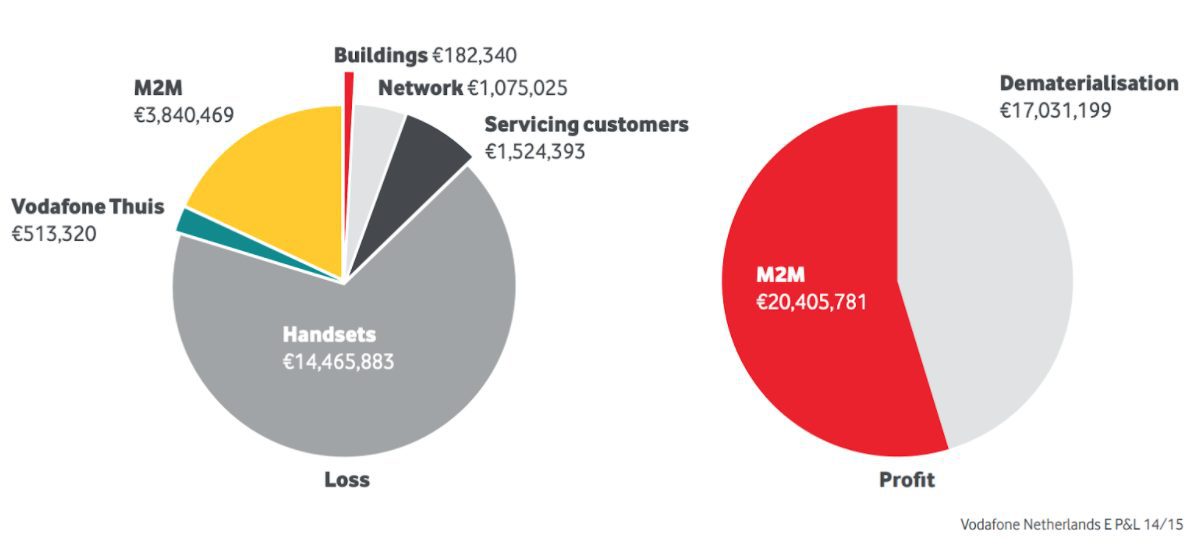

In 2014, Vodafone Netherlands, which had 5.2 million users back then- was the first company in its sector, to perform a full EP&L.

Their 2014 EP&L showed that the impact hotspots (the environmental loss) come from the production of their handsets- with 62% (€14.5 million) of their total environmental footprint (a component of a telephone that a user holds to the ear and mouth to receive audio through). The second biggest hotspot comes from the production of their M2M modems- with 17%(€3.8 million).

Vodafone deducted strategic insights from these results. Their *M2M solutions have the potential to help their customers and suppliers reduce their environmental impact. So, (1) they should make sure to innovate further with these types of smart products and services. (2) Secondly, Vodafone will implement circular business models to address their large production footprint. This includes increasing the length of the use span of handsets, selling refurbished devices, and buying back customer’s devices.

*Vodafone’s M2M connectivity improves efficiency and includes; smart grid, smart logistics, smart cities, and smart manufacturing.

→ Read Vodafine’s full 2014 EP&L report right here.

4. Puma (part of Kering group)

As stated in the beginning of this article, Puma is thé trendsetter for EP&L accounts since 2011. Annual EP&L’s have allowed them to stay on top of their sustainability strategy since day 1. And continuously extend their previous sustainability targets.

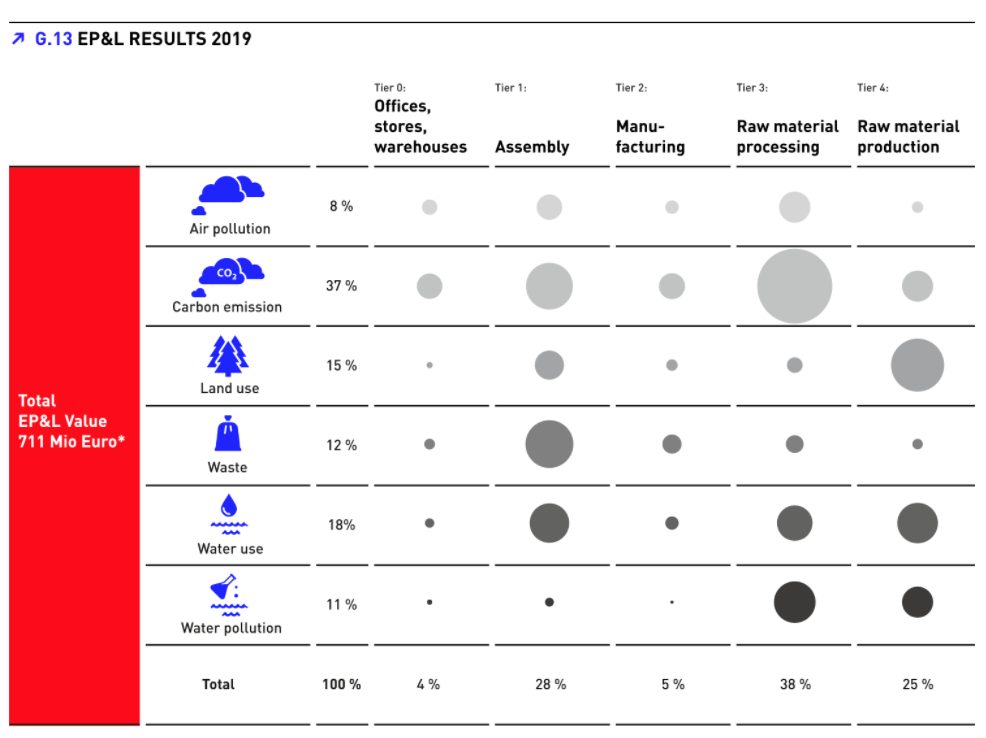

Their EP&L account from 2019 revealed that 63% of their total environmental footprint comes from their raw material processing (38% = €270 million) and production (25% = €177.8 million).

Therefore, Puma has decided to prioritize the large-scale use of more sustainable raw materials. They extended their previous targets to new targets; to source 100% (instead of 90%) of their cotton, polyester, leather, down feathers, and cardboard from more sustainable sources by 2025. They do so in partnership with their material suppliers.

→ You can find Puma’s full 2019 EP&L account and the environmental KPI’s of their entities for 2021 right here.

5. Novo Nordisk

Finally, there’s the Danish Novo Nordisk: the first multinational pharmaceutical company in the world to perform an EP&L. After Puma, Novo Nordisk was one of the first to explore the EP&L method as well.

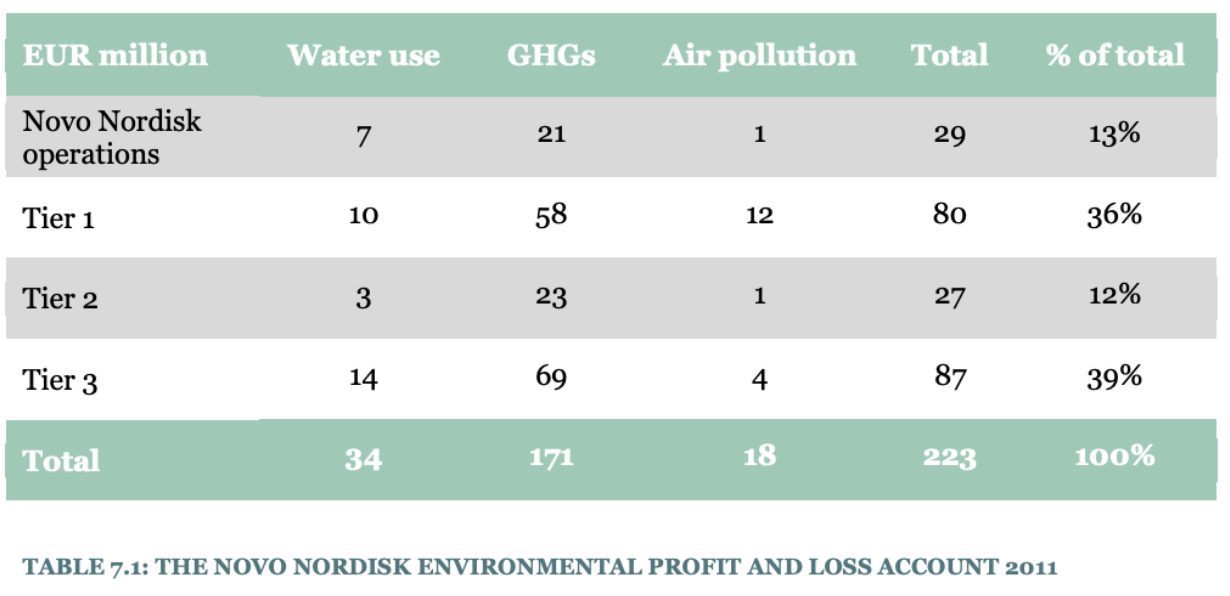

In 2011 they performed an EP&L account to create the foundation for their sustainability strategy. As visible in figure 5, their main environmental impact hotspots come from Tier 1 and 3 (75% of total footprint). Tier 1 being the production of products and services- with 36% (€80 million). And Tier 3 being the extraction of raw materials or cultivation of farm crops- with 39%(€87 million).

Novo Nordisk was now able to further specify their sustainability efforts with 3 initiatives. (1) To completely switch to renewable energy- a target they met in 2020. They extended this goal to becoming completely carbon zero by 2030. (2) To continuously design eco-friendly products and apply ecodesign in their production. (3) To increase collaboration with their supply chain and embed circular thinking and sourcing for their raw materials.

→ Read Novo Nordisk’s full 2011 EP&L right here.