Have you followed the news recently? If you have, you have probably heard someone talk about Carbon Tax.

More than 40 countries already have a system for carbon taxation in place or are talking about implementing some sort of carbon price.

Above all, Carbon Tax is supposed to make it more expensive to emit carbon. But while it is a widely discussed topic, it is not a widely understood one. This article will give you a step by step guide towards fully understanding carbon tax and explain the principle behind it, carbon pricing.

Heads up: We will dive deep into the economic concepts behind carbon pricing. If you are in a rush and just want to understand the different carbon pricing policies (carbon tax and cap & trade), just click here and we will take you right to the paragraph.

This article covers

-

What are carbon dioxide emissions and how can we measure them?

-

What is the social cost of carbon?

-

Externalities

-

Shadow prices

-

Carbon pricing policies

-

Carbon Tax

-

Cap & Trade

What are carbon dioxide emissions and how can we measure them?

Greenhouse gases 101

Together with nitrous oxide (N2O) and methane (CH4), hydrofluorocarbon (HFCs), perfluorocarbon (PFCs) and sulfur hexafluoride (SF6), greenhouse gases are the main cause of climate change.

The different emissions are characterised by the use of indices known as characterisation factors. These factors indicate how much a standard quantity of a given pollutant contributes to a particular environmental impact. Therefore, the higher the characterisation factor, the greater the contribution.

For example, the gas methane has a higher factor than carbon dioxide.

This is equivalent to saying that a kilo of methane causes more global warming than a kilo of carbon dioxide.

In order to still be able to speak of a single indicator the different emissions are added up based on their characterisation factors and written down as carbon dioxide equivalents (CO2e) forming the Global Warming Potential (GWP).

Global Warming Potential (GWP)

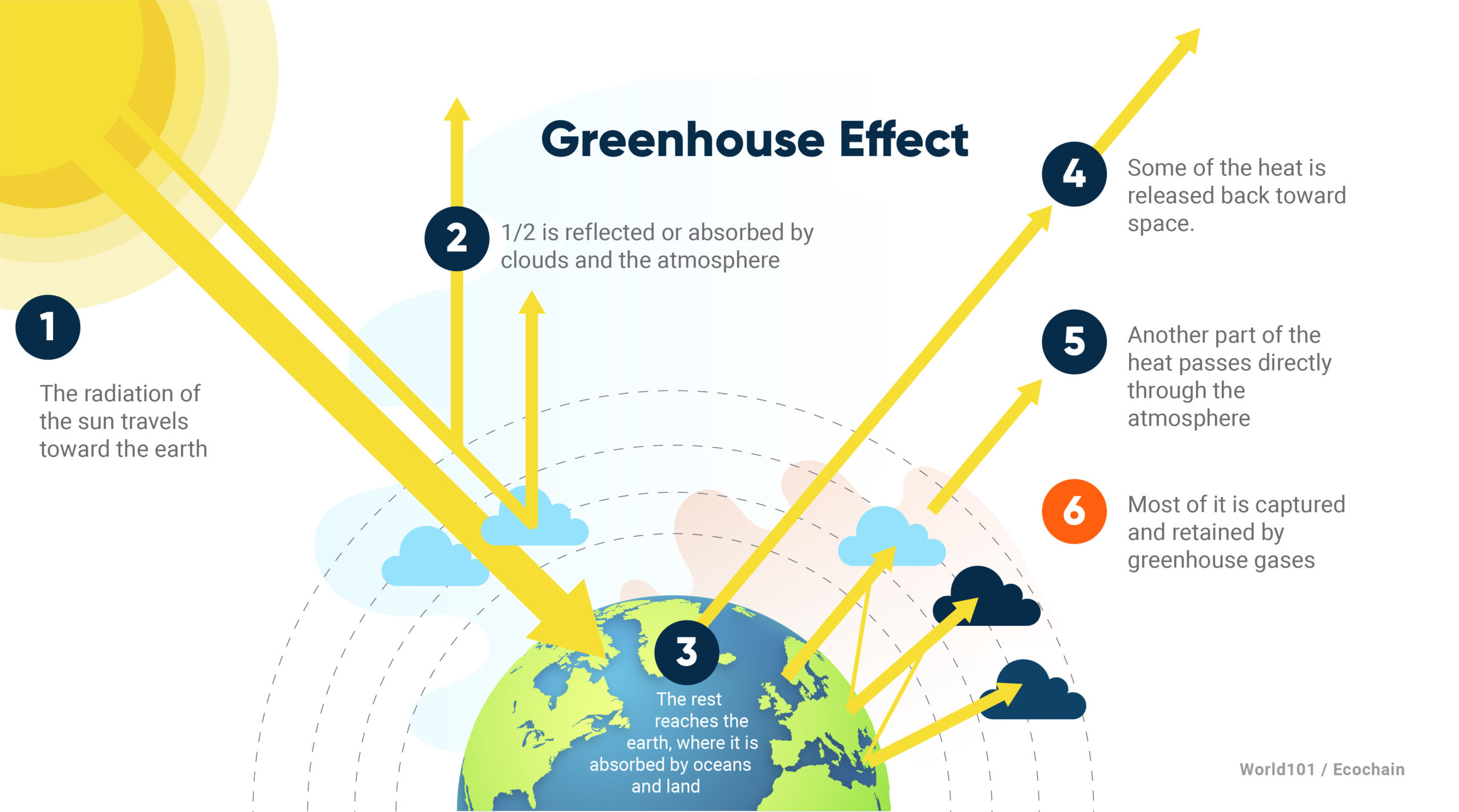

The GWP is a measure of how much energy is absorbed by 1 ton of gas over a period of 100 years. Gases absorb the sun’s radiation which is reflected by the earth causing the heat to cover the earth like a blanket.

So far, two distinct methodologies have been used for calculating CO2-eq footprints; the component method (Life Cycle Assessment) and the compound-based method (Environmental input-output).

The Life Cycle Assessment (LCA) is a bottom-up method, which has been developed to understand the environmental impacts of individual products from cradle to grave.

An environmental input-output (EIO) analysis provides an alternative top-down approach to carbon foot accounting. Input-output tables are economic accounts providing a picture of all economic activities at the meso (sector) level, therefore EIO should be considered less accurate than a LCA.

Get ready for carbon tax in 5 steps. Download our quick guide now.

How much would we pay for clean air?

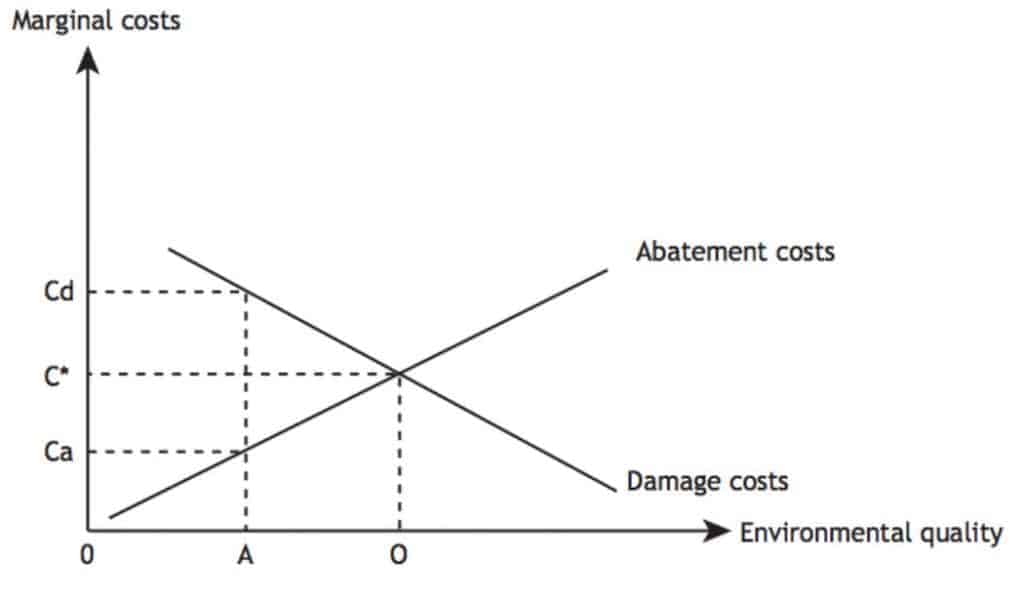

Standard economic theory shows that if you could buy clean air, society would buy it up until the point where the benefits of one additional unit of clean air equals the cost of one additional unit of pollution reduction.

This point represents the optimal level of pollution, also known as Pareto-optimality shown in figure 2 marked O.

Equilibrium prices

Equilibrium prices indicate the true economic value of pollution if all externalities are internalised. But when they are not internalised, how do we estimate the costs?

We can do this in two ways:

Damage costs

The cost that emission is causing to society. This shadow price is given by Cd and expresses the marginal damage costs.

Abatement costs

The cost of preventing/reducing emissions. A shadow price for the abatement cost function. This shadow price, given by Ca, expresses the marginal abatement costs.

Damage costs

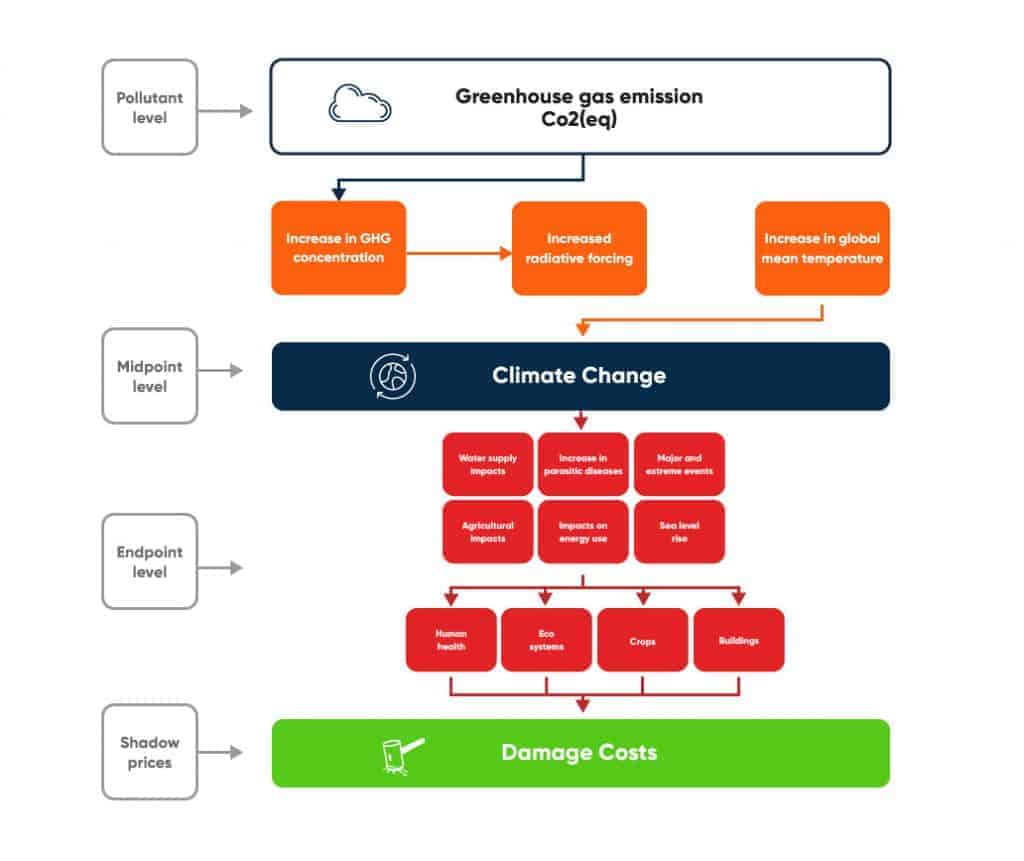

If we want to calculate damage costs, we need to calculate the costs of the consequences of climate change.

Pollutant level: For example, CO2 and CH4 contribute to climate change.

Midpoint: Different pollutants are contributing to climate change, expressed in Global Warming Potential (GWP)

Endpoint: The midpoints eventually have an effect on endpoints such as:

- Damage to human health

- Damage to ecosystems

- Damage to resource availability

- Material damage

Figure 6 shows the impact pathway from pollutant level to endpoint level. There are several consequences of climate change that pose a cost to humanity:

Sea level rise

This may lead to loss of land. Impacts can be measured in terms of costs of protection. Another impact is the cost of human migration.

The impact of climate change on energy use

This will depend on temperature changes that will cause a change in heating and cooling of certain areas.

Agricultural impacts are related to changes in cultivated areas

The yield of certain crops will depend on changes in temperature and precipitation.

Impacts on water supplies

In some areas water shortages will be more severe. Water scarcity globally is likely to increase.

Health effects

Such as increased incidence of certain parasitic diseases like malaria.

Ecosystem and biodiversity impacts

Increased risk of extinction of certain vulnerable species. Also systems like coral reefs are at risk.

Extreme events such as heat waves

Droughts, storms and cyclones could occur more frequent.

Major events

For example, the loss of the Greenland ice sheet, or the collapse of the Amazon Forest.

How high are the social costs of carbon, really?

A meta analysis conducted by Dutch professor Richard Tol from the Vrije Universiteit in Amsterdam estimated the social costs of carbon.

The analysis resulted in an average of 53 $ per ton of CO2 in 2010.

Furthermore, the meta analysis showed that there is a large uncertainty of the exact social cost of carbon.

| SCC per ton CO2 (Tol, 2009) 1995 values | SCC per ton CO2 (Tol, 2013) 2010 values | |

| Average | $41 | $53 |

| Median | $24 | $37 |

| 95th percentile | $146 |

Discount rates and the Stern Review

The effects of climate change will be felt over many hundreds of years, whereas cutting emissions costs money now. How should we weight the value today of costs and benefits in the future? Economists approach this by using a discount rate. All studies are highly sensitive to the discount rate that is used. Essentially, the discount rate is used as a corrective to reflect the opportunity costs of carbon pricing – it compares the value today of costs and benefits in the future. Thus, a high discount rate results in a low cost. A high discount rate would suggest that life today is more important than the life of future generations.

A study, called the Stern Review, was an outlier but is widely discussed for using a low discount rate of only 1,4% (instead of 6%), which led to a social carbon price of 85$ per ton of CO2.

Damage cost can be useful to estimate the cost of the consequences of climate change. It is however difficult to arrive at a consensus because of the following challenges;

- Difference in discounting

- Monetary valuation of human life

- Development countries vs. developed countries

- Inequality distribution of impacts and income

- Incomplete treatment of risk

- Neglect of certain costs or incomplete inclusion

Abatement costs

Because of the high uncertainty in damage cost, policy makers often use the abatement cost of climate change.

The abatement cost method calculates the costs of preventing or mitigating the effects of climate change. The marginal abatement costs, measures the cost of reducing one more ton of CO2e. This cost is highly dependent on climate policies and is therefore strongly subject to policy changes.

Currently the European Union (EU) has set an ambitious GHG reduction goal of 40% for 2030. After 2030 there are no binding agreements yet.

Furthermore, the EU has opted for even more stricter reductions up to 80-95% compared to the 1990 level. Besides, during the Paris agreement summit all parties agreed on a maximum increase of the global temperature of two degrees Celsius (with an aim on 1,5 degrees Celsius). This will mean an emission reduction of around 95%.

Therefore, the abatement costs can be based on the following possible scenarios:

- The EU climate policy up to 2020. This involves concrete price agreements of EU ETS and a 20% decrease in GHG emissions compared to 1990 levels.

- The EU climate policy to reduce up to 40% of the GHG emissions before 2030.

- The Paris Agreement to reduce global warming up to 2 degrees Celsius (with an aim for 1,5 degrees Celsius).

Because we want to aim for the highest amount of reduction, we will base abatement costs on the ‘2 degrees target’. The idea behind this is that a specific region must take prevention measures to reduce CO2e emissions to reach its target.

From an economic perspective, the cheapest measures (in terms of euro/kg) are taken first. This is shown in the Abatement Cost Curve. The abatement methods on the left will have a positive effect on costs, while the abatement methods on the right represent an abatement costs. The width of each bar represents the impact of the measure on CO2e emissions. The abatement methods on the left will have a negative cost meaning that the measure will actually pay for itself while the abatement options on the right represent an actual cost. The width of each bar represents the impact of the measure on CO2e emissions.

Abatement Cost Curve | McKinsey

At a certain point at the curve, the reduction of the emissions is sufficient to bring the concentration of the pollution below the no-effect-level. This level of CO2e emissions is the level that the emissions and the natural absorption of the earth are in equilibrium again at the maximum temperature rise of 2 degrees Celsius.

The next step is to determine the most expensive technical measure of the set of possible measures that is required to reach the no-effect-level. Such a calculation results in the Best Available Technology which is required in that region. The price of that technology is expressed in €/kg and is called the marginal prevention cost under BATNEC (Best available Technology Not entailing Excessive Costs).

Based on this methodology the Dutch research project WLO by PBL and CPB calculated prevention cost prices. Their research finds that carbon abatement prices could rise up to the range of € 200 – 260 / tCO2 in 2050.

Carbon pricing policies

Now we know why and how we put a price on carbon. We showed what CO2 price is needed to not increase the global temperature by more than 2 degrees.

However, in real life politics come into play when setting a price for carbon. There are currently over 40 countries that have some sort of carbon price ranging from 1 to 130 $ per ton of CO2e. The policies can be split into Carbon tax and Cap & Trade.

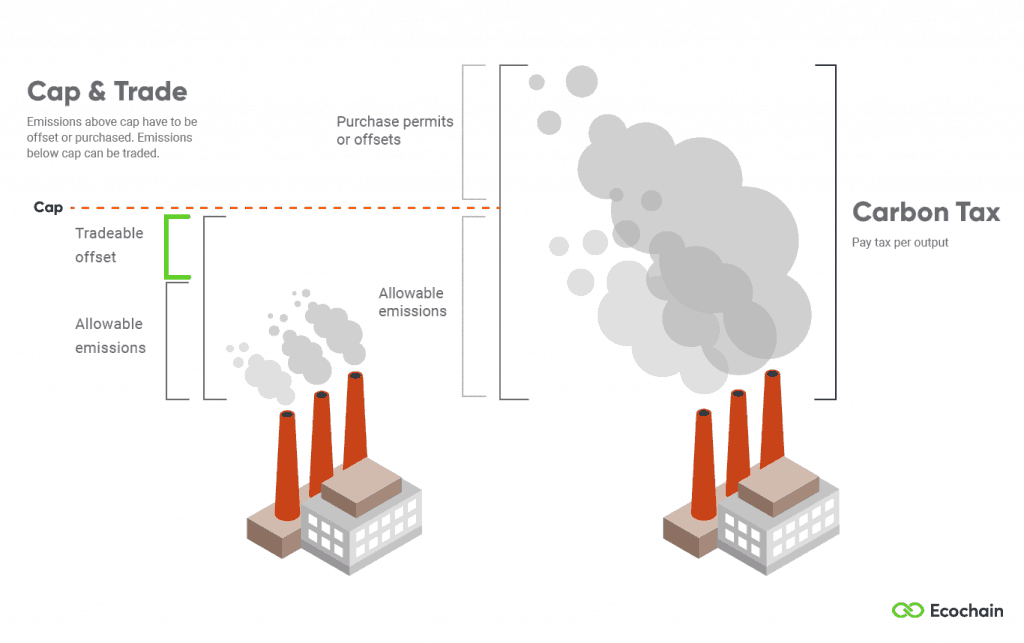

Carbon tax

A carbon tax is a tax that is levied on carbon and is a form of carbon pricing. It is a proven policy to reduce greenhouse gas emissions.

The carbon tax sets the level of demand and supply at the social optimum and avoids an externality if set on the right price.

Prices lower than the actual social cost of carbon still lead to an undesirable level of pollution but will still help to reduce emissions.

Cap & Trade

This is a form of emissions trading that limits emissions and puts a price on them.

The cap on greenhouse gas emissions is the limit on pollution. Subsequently, it will get stricter over time.

The trade part is a market for companies to buy and sell allowances that let them emit only a certain amount, as supply and demand set the price. Trading gives companies a strong incentive to save money by cutting emissions in the most cost-effective ways.

The government sets the cap across a given industry, or ideally the whole economy. It also decides the penalties for violations. Carbon dioxide and related pollutants that drive global warming are main targets of such caps. Other pollutants that contribute to smog can also be capped.

The European trading system is one of the best known cap & trade systems. The EU ETS painfully showed the weakness of such a system. The EU ETS had build up a big surplus of allowances since the economic crisis in 2008. The economic crisis reduced greenhouse gas emissions more than anticipated leading to the big surplus. This led to lower carbon prices and thus a weaker incentive to reduce emissions.

Carbon Tax and social costs

Since they profoundly drive climate change, greenhouse gases have an effect on society. However, what is that effect on society? We all know that the temperature is rising, but how can we put a price on this?

Externalities: The bigger picture of our economic action

The effects of the emission of greenhouse gases on society is a topic that has been extensively researched in the field of welfare economics.

The effect can be valued and calculated by the use of externalities. To understand this we will briefly go through the concept of externalities.

Subsequently, we will introduce the term shadow prices with the help of abatement costs and damage costs.

Economic markets don’t produce an efficient allocation of goods and resources. One of the reasons for this are externalities. Externalities can be either positive or negative.

Positive externality – Example

A beekeeper who keeps bees for their honey. A side effect or externality associated with such activity is the pollination of surrounding crops by bees. The value generated by pollination may be more important than the value of the harvested honey.

Negative externality – Example

When producing steel the factory uses energy in its processes. This energy use causes the pollution of greenhouse gas. This pollution is a negative externality. Without any regulation, the production decisions of companies will not account for the social and ecological damages of pollution. Furthermore, consumers will also not limit their purchases because of pollution.

The effect of externalities on the market

In the negative example, both parties do not take the externality into account. This will cause the market to produce too much of the product. This is indicated in figure x by the market equilibrium.

When the social costs are incorporated we arrive at the social optimum, showing us that we need to produce less for a higher price. As a result, in order to correct the inefficient market equilibrium, the prices need to be set right. Consequently, we need to know the price we have to add.

This is where the concept of shadow prices comes to play.

Shadow prices

Shadow prices show the actual price of a product or material. Shadow prices are currently used as a tool in a wide range of decision-making processes, particularly by government and industry.

They provide input in two ways:

Shadow prices can serve valuation

In analysing the social effects of an investment decision, shadow prices can be used to take environmental impacts on board alongside financial considerations by assigning them a monetary value. Here, the principal aim is valuation.

Shadow prices can serve weighting

In environmental analysis, shadow prices can be used to assign a relative weight to each of the environmental impacts identified. Here, the goal is environmental weighting, with shadow prices providing a means of comparing environmental impacts based on the same unit of measurement (for example monetary value). A common example of this is the Environmental Cost Indicator, that is often being used for public construction tenders.

Valuing environmental quality

Valuing environmental quality means expressing the value of environmental quality to society in monetary terms.

However, as the value of environmental quality cannot always be obtained directly (via market prices for example), it must be obtained through calculation.

Monetising environmental impacts dates back to the early 1930. Since then, major efforts have been made on both methodological development and practical valuation studies.