Below you will find the full YouTube video of our interview with Alain Deckers. Continue this page for the summary.

1. All large companies in Europe- listed or not – are compliant with the CSRD.

In total that’s an estimation of 50.000 companies directly covered by the CSRD. These companies have to meet two out of the following three criteria:

- €40 million in net turnover;

- €20 million on the balance sheet;

- 250 or more employees.

Listed SME’s will have to report from 2026 onwards. Based on more targeted and simpler reporting requirements.

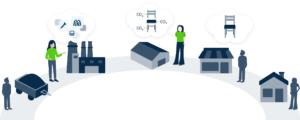

The CSRD indirectly affects suppliers too

The effect of the CSRD will trickle down into companies’ supply chains. To meet the reporting requirements, CSRD compliant companies will most likely request sustainability information from their suppliers (tier 1).

“Those companies that are required to report according to the CSRD, will likely request information from their suppliers. For example, in order to be able to comply with the reporting requirements. So, this is likely to trickle down into the supply chain. Not immediately to all companies- but it will first hit the first tier suppliers from large companies. And then they themselves may have to request information from their own suppliers.”

Alain Deckers, Head of the European Commission’s Corporate Reporting Unit

2. Large companies have to produce their first report in 2024- over 2023 financial years.

This is the proposed timing- the timetable could still change as the CSRD is going through the legislative process right now. Listed SME’s start three years later in 2026 and have more time to adapt.

3. Companies have to report the full ESG spectrum, including 6 additional environmental objectives from the Taxonomy.

The proposed CSRD Reporting Requirements, cover the full ESG spectrum: Environment, Social & Governance. E.g. the requirements in ‘Environment’ are defined in terms of the 6 environmental objectives already mandatory in current legislation; the Taxonomy (EU’s Sustainable Finance Package). These can be calculated via a company footprint (LCA).

The European Financial Reporting Advisory Group (EFRAG) is creating the final reporting requirements for the CSRD. These are created in collaboration with other important international standards to ensure alignment. E.g the Global Reporting Initiative (GRI) and The International Financial Reporting Standards Foundation (IFRAS).

4. The CSRD requires intensive preparation for forward-looking information.

Preparing for the CSRD, will need technical and detailed work. E.g. finding out how you will collect the data you need to report. This requires looking at IT systems and the reporting procedures within your company.

However, the CSRD also highly focuses on forward-looking information. How is sustainability related/integrated with your business model, strategy, policies, objectives and targets?

“My advice would be: this is not something that can just be managed as a technical process. It is something that is in the future going to be central to business strategy and it really needs senior management and board attention”.

Alain Deckers, Head of the European Commission’s Corporate Reporting Unit

5. Companies need to start preparing for the CSRD soon.

1. “It’s never too early to start preparing.” You can already start with finding out how to retrieve all the necessary information. E.g. how to measure the 6 environmental criteria from the Taxonomy.

2. The CSRD is still going through its legislative process. But the EFRAG, who is developing the reporting standards released mid-2022- is already making information public on their website (E.g status report). You can follow this work and leave input.

6. The CSRD creates focus on sustainability in investment portfolios.

Whether it’s investors, asset managers, banks or insurance companies- all are increasingly under pressure from the market’s expectations. Or they are required by regulations to report about– and manage their own sustainability-related risks.

These financial institutions or markets are increasingly going to demand sustainability information from companies they invest in, or provide loans.

“But it is wider than just climate- it’s biodiversity and other environmental issues- also social issues; human rights, etc. There’s a broad demand for this kind of information. And reporting about these issues should really become the new normal.”

Alain Deckers, Head of the European Commission’s Corporate Reporting Unit

7. European Single Access Point will simplify & connect all company’s CSRD data.

Investors in financial markets increasingly want sustainability information to be available in digital format. However, they also have to be able to find this information.

The CSRD answers this need with the European Single Access Point (ESAP). ESAP’s goal is to provide a single interface where users (investors, NGO’s, etc.) can access information from any company they’re interested in. Even if that information is actually stored somewhere else- ESAP makes it look like a single database.

8. Final tip for companies from Alain Deckers:

- Don’t wait. These deadlines may seem far away. But they are not. And they require preparation. Which, businesses need to start doing as soon as possible.

- Don’t treat this as a purely technical exercise. Companies really need to look at this from a strategic point of view. How does this fit with your overall business model, and your overall company strategy? There’s the pressure from our climate crisis and meeting the European carbon neutrality targets. Sustainability has to be integrated in business strategies.

“And that’s why it should be underlined that in the future-in my view- this is going to become an integral part of business strategy and business procedures. This is just something that has to be built into. It’s not just a nice-to-have.”

Alain Deckers, Head of the European Commission’s Corporate Reporting Unit