Making money and saving the planet always seemed like polar opposites. Only recently have businesses started building their strategies upon sustainability as a long-term driver for value.

BlackRock manages more than 9 trillion US dollars in assets, which makes them the world’s biggest asset manager. And their latest research on the UN Sustainable Development Goals (SDG) shows: Making SDG impact is closely tied to financial impact.

Let’s break down BlackRock’s findings.

Financial Materiality: Sustainability meets financial condition

The SASB is a global nonprofit organization that guides the disclosure of sustainability information from companies to their investors. As such, their very reason of existence is to make the financial impact of sustainable decisions transparent.

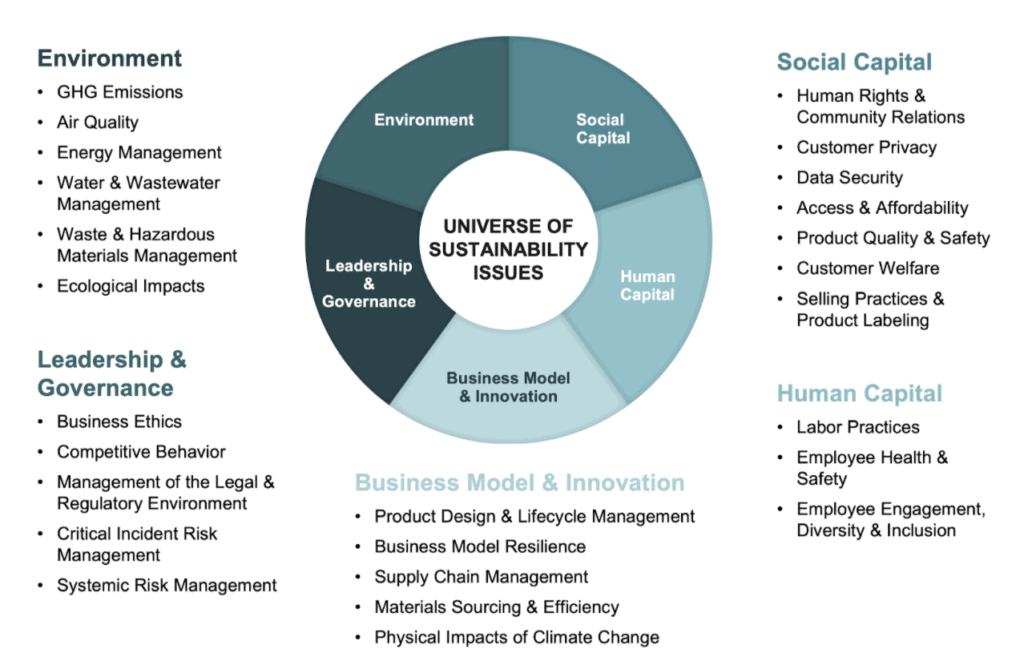

They use their own framework, which is divided into 5 sustainability dimensions (environment, social capital, human capital, business model & innovation, leadership & governance).

These 5 sustainability dimensions are further defined by 26 sustainability issues (see graphic).

So far, this looks like just another way to look at SDGs. That’s where the SASB Materiality Map closes the loop.

980 indicators for financial impact

The SASB Materiality Map is a publicly available tool that connect sustainability to financial impacts, in what SASB calls “financially material issues” – issues that are “reasonably likely to impact the financial condition or operating performance of a company, and therefore most important to investors.”

It’s a pretty interesting deep-dive into different industries. BlackRock took that data and mapped it to the SDGs– thereby identifying which SDGs cover financially material issues.

And what did they find?

Finding the overlap: How the SDG indicators overlap with financial materiality indicators

BlackRock’s analysis showed that more than 70% of Materiality indicators were to be found in the SDG indicators, with especially high overlap in the environment, business model, and human capital categories.

Especially mining materials and infrastructure massively financially benefit from adopting the SDGs. Food & Beverage and transportation are also highly mapped to material impact.

The paper makes it clear that: the cost of not achieving the UN SDGs is greater than the cost of action. Big market opportunities await – that should be clear for even the most conservative investor.

The original research document is unfortunately not available to the public.